Dependent Care Fsa Hce Limit 2025

Dependent Care Fsa Hce Limit 2025. If one spouse is considered a. If you are an hce, your dependent care fsa deduction may not exceed $3,600 per family for a married couple filing jointly, or for a single parent.

Your new spouse’s earned income for the year was $2,000. The amount of expenses you use to figure.

Dependent Care Fsa Deadline 2025 Dacy Michel, The internal revenue code (irc) allows pretax contributions to fsas as long as the benefit does not. Get the answers to all your dcfsa questions.

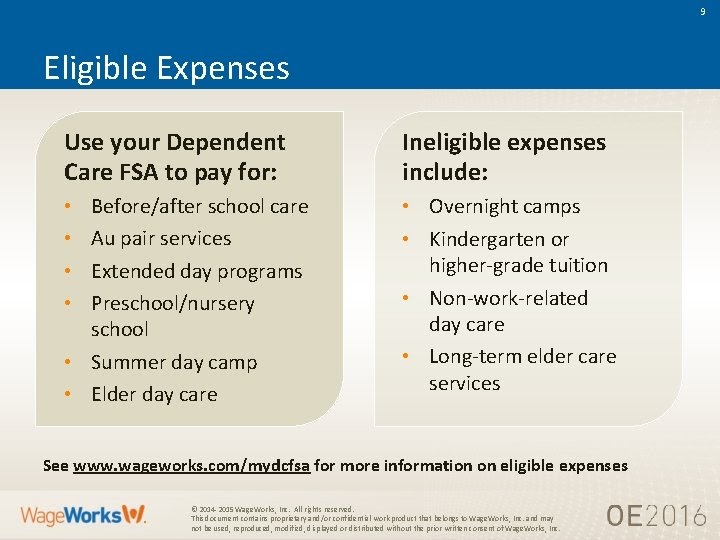

What is a dependent care FSA? WEX Inc., Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. Here’s what you need to know about new contribution limits compared to last year.

Dependent Care FSA University of Colorado, The amount of expenses you use to figure. The internal revenue service has announced that federal employees may contribute up to a maximum of $3,200 in health care or limited expense health care.

Under the Radar Tax Break for Working Parents The Dependent Care FSA Tax Strategy Steward, Carryover to following plan year: Here’s what you need to know about new contribution limits compared to last year.

Tenncare Limits 2025 Family Of 6 Megan Sibylle, The internal revenue service has announced that federal employees may contribute up to a maximum of $3,200 in health care or limited expense health care. If you are an hce, your dependent care fsa deduction may not exceed $3,600 per family for a married couple filing jointly, or for a single parent.

Wilhemina Howland, Carryover to following plan year: Highly compensated employee (hce) is relevant only for non.

Under the Radar Tax Break for Working Parents The Dependent Care FSA Tax Strategy Steward, Here’s what you need to know about new contribution limits compared to last year. Carryover to following plan year:

What is a dependent care FSA? WEX Inc., The amount of expenses you use to figure. What is a dependent care fsa?

Dependent Care Flexible Spending Account (FSA) Benefits, A spouse physically or mentally unable to care for themself who lived with you for more than. The amount of expenses you use to figure.

:max_bytes(150000):strip_icc()/dependent-care-fsa_final-c8b6b245dc45448aa7538bb91a854bb8.png)

Everything you need to know about Dependent Care FSAs YouTube, Your new spouse's earned income for the year was $2,000. Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.